INVESTMENT SERVICES

Helping African countries access finance to bridge the huge investment gap remains a foremost priority. AFRIEF’s Investment Services (AIS) support countries and private sector organizations by developing bankable projects, national financing vehicles and risk reducing instruments to bridge the gap between finance and projects. AFRIEF delivers these services by:

- Developing a pipeline of bankable Halal economy projects;

- Performing the role of an “arranger”, that is, designing and structuring commercially viable Halal projects that attract appropriate finance, and getting them financed;

- Structuring financial solutions that blend public/concessional finance and commercial/private finance in order to reduce risk and consequently help position public and private parties with commercially viable project structures;

- Designing innovative financial mechanisms often in the form of funds and instruments that reduce and possibly mitigate risks and overcome other barriers specific to Halal economy;

- Establishing dedicated vehicles capable of blending international and domestic sources of capital for financing Halal economy;

- Prioritizing projects and instruments that are impactful and catalytic, i.e. they mitigate risk sufficiently to pave the way for private investment in the sector;

- Integrating social and environmental considerations into projects, valuing and monetizing natural assets where possible;

- Advising partner countries and private sector organizations on the development of their investment plans, and

- Forging Private Public Partnerships, fostering best practices and encouraging collaboration through publications, forums, workshops and other forms of support for governments, private sector entities and communities to tap the Global Sukuk capital markets.

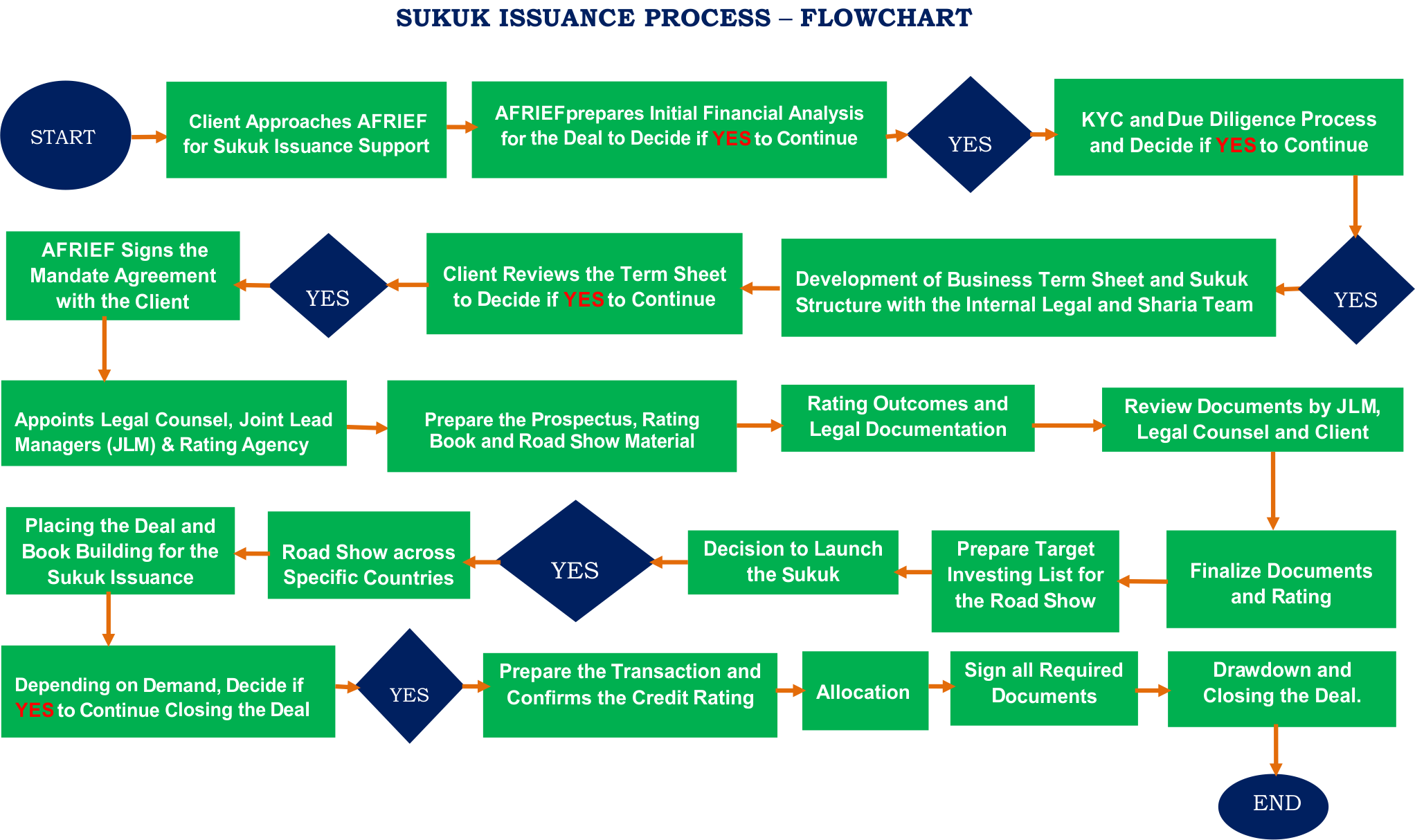

Below is the flowchart of our sukuk driven investment services.